In the rapidly evolving world of digital payments, finding the right software development company for AEPS (Aadhaar Enabled Payment System) software can be challenging. One name that stands out in this domain is Camlenio. This article will delve into why Camlenio is the best choice for AEPS software development, what makes their services exceptional, and how they can cater to your needs effectively.

Introduction

In today’s digital age, ensuring secure and efficient financial transactions is paramount. AEPS has revolutionized the way people access banking services, particularly in rural areas. With the surge in demand for AEPS services, it’s crucial to partner with a reliable software development company that can deliver robust solutions. Camlenio emerges as a top contender in this space, offering unmatched expertise and innovation in AEPS software development.

Software Development Company for AEPS Software

AEPS, or Aadhaar Enabled Payment System, is a secure payment platform that allows users to perform financial transactions using their Aadhaar number and biometric authentication. This system, introduced by the National Payments Corporation of India (NPCI), enables banking transactions such as cash withdrawals, balance inquiries, and funds transfers without the need for a traditional bank card.

Importance of AEPS in Fintech

AEPS has revolutionized the financial sector, particularly in rural areas where access to banking services is limited. It has made banking more accessible and convenient, reducing the dependency on physical bank branches. AEPS is also a key driver in financial inclusion, helping millions of unbanked individuals gain access to essential banking services.

Key Features of AEPS Software

When looking for AEPS software, there are several key features to consider:

- Biometric Authentication: Secure transactions using fingerprint or iris scans.

- Interoperability: Works across various banks and financial institutions.

- Real-time Transactions: Instant processing of transactions.

- User-friendly Interface: Easy to navigate for users of all technical abilities.

- Comprehensive Reporting: Detailed transaction logs and reports for better management.

Why You Need a Reliable Development Company

Choosing the right software development company for AEPS software is crucial. A reliable company ensures the software is secure, efficient, and tailored to your specific needs. The right partner will also provide ongoing support and updates to keep your system running smoothly and in compliance with the latest regulations.

Read More: https://camlenio.com/blogs/best-custom-fintech-software-development/

Camlenio: A Pioneer in AEPS Software Development

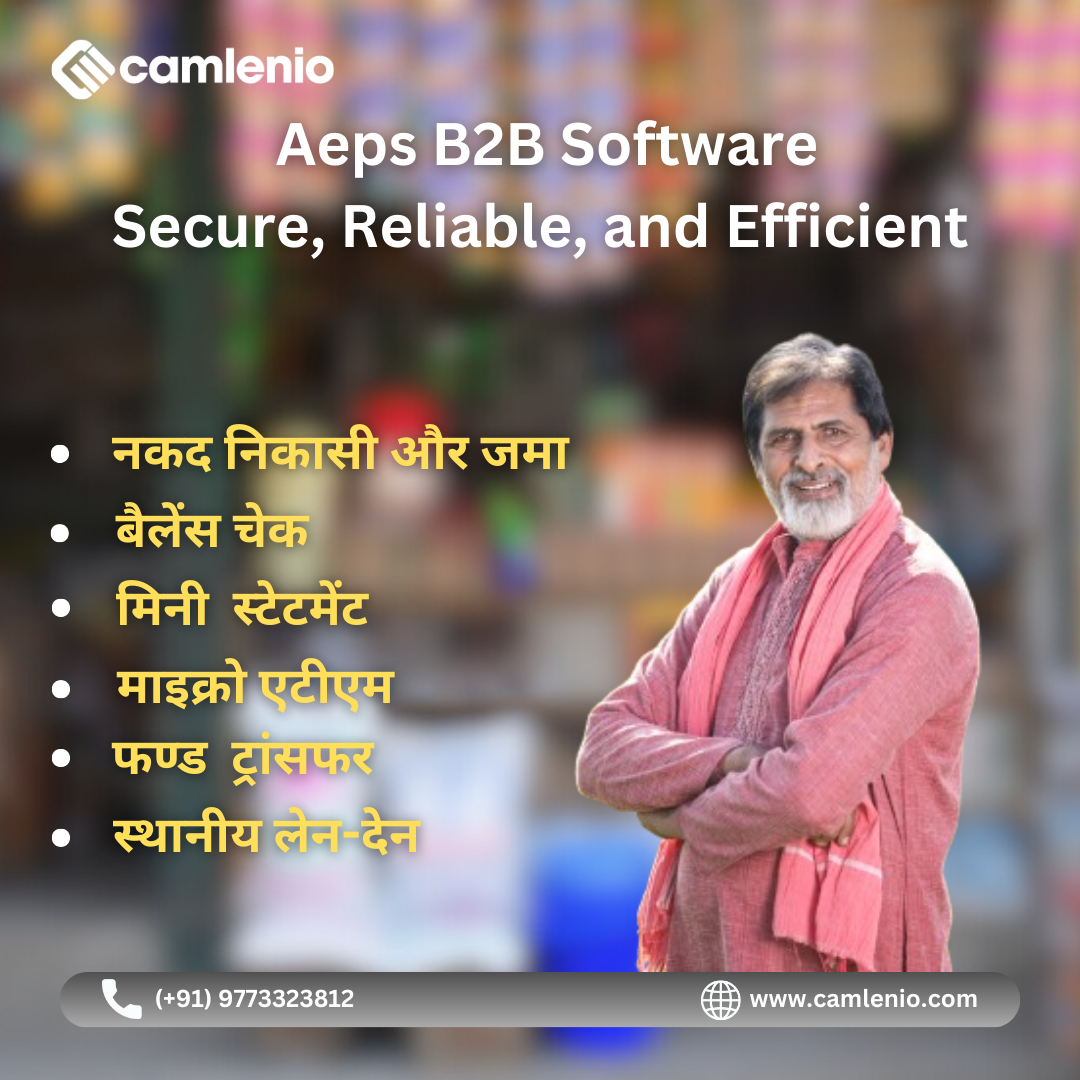

Camlenio has earned a stellar reputation for its comprehensive and user-friendly AEPS software solutions. The company’s commitment to innovation, security, and customer satisfaction has made it a preferred choice for businesses looking to implement AEPS. Camlenio’s AEPS software is designed to provide a seamless experience for both users and administrators, ensuring that transactions are quick, secure, and easy to execute. The software integrates advanced biometric authentication, robust security protocols, and intuitive user interfaces, making it accessible even to those with limited technical knowledge.

One of the key strengths of Camlenio’s AEPS software is its adaptability. The company understands that different clients have unique needs and offers customizable solutions to meet these specific requirements. Whether it’s a small financial institution or a large enterprise, Camlenio provides tailored AEPS software that aligns with the client’s operational goals and regulatory compliance standards.

Criteria for Choosing the Best AEPS Software Development Company

When selecting a development company, consider the following criteria:

- Experience: Look for companies with a proven track record in AEPS software development.

- Security: Ensure the company prioritizes security features such as biometric authentication and data encryption.

- Customization: The ability to tailor the software to your specific needs is crucial.

- Support: Ongoing technical support and regular updates are essential.

- Cost: Consider the overall cost and ensure it aligns with your budget.

Benefits of Custom AEPS Software

Custom AEPS software offers several benefits over off-the-shelf solutions:

- Tailored Features: Custom software is designed to meet your specific business needs.

- Scalability: Easily scalable to accommodate growing transaction volumes.

- Competitive Advantage: Unique features can give you an edge over competitors.

- Better Integration: Seamlessly integrates with your existing systems and workflows.

Challenges in Developing AEPS Software

Developing AEPS software comes with its own set of challenges:

- Security Concerns: Ensuring the highest level of security to protect sensitive user data.

- Regulatory Compliance: Keeping up with changing regulations and ensuring compliance.

- User Adoption: Designing user-friendly interfaces to encourage adoption.

- Technical Support: Providing continuous support to address any technical issues.

Future of AEPS Software

The future of AEPS software looks promising with advancements in technology and increasing adoption. Key trends to watch include:

- Enhanced Security Features: Advanced biometric authentication and encryption techniques.

- Integration with Other Payment Systems: Greater interoperability with other digital payment platforms.

- AI and Machine Learning: Utilizing AI for fraud detection and improved user experiences.

- Blockchain Technology: Incorporating blockchain for added security and transparency.

Conclusion

Choosing the best software development company for AEPS software is a crucial decision that can significantly impact your business. By considering factors such as experience, security, customization, support, and cost, you can find the right partner to develop a robust and reliable AEPS solution. The future of AEPS software is bright, with exciting advancements on the horizon that will continue to enhance its capabilities and benefits.

FAQs

1. What is AEPS software?

AEPS (Aadhaar Enabled Payment System) software allows users to perform financial transactions using their Aadhaar number and biometric authentication.

2. Why is AEPS important in fintech?

AEPS is crucial in fintech because it enhances financial inclusion, especially in rural areas, by providing accessible banking services without the need for a traditional bank card.

3. What features should I look for in AEPS software?

Key features include biometric authentication, interoperability, real-time transactions, a user-friendly interface, and comprehensive reporting.

4. Can Camlenio customize AEPS software to meet my specific needs?

Yes, Camlenio offers customized solutions tailored to the unique requirements of each client.

5. What are the benefits of custom AEPS software?

Custom AEPS software offers tailored features, scalability, a competitive advantage, and better integration with existing systems.