Introduction

Managing loans can be a complex and time-consuming process for financial institutions. It offers a solution by streamlining loan processing, improving efficiency, and enhancing customer experience. In this article, we will explore the key features of loan management software, the benefits it offers, and how to choose the right solution for your needs.

Understanding Loan Management Software

It is a specialized system designed to automate the loan lifecycle, from application to repayment. It helps financial institutions manage loans more efficiently by automating tasks such as application processing, underwriting, and servicing. This software also provides tools for managing borrower information, tracking loan performance, and ensuring compliance with regulations.

Key Features of Loan Management Software

Automation

Automation is a key feature of loan management software. It helps streamline processes such as application processing, underwriting, and payment processing, reducing the time and effort required to manage loans.

Customization

The software should allow for customization to meet the specific needs of your institution. Look for software that allows you to tailor workflows, forms, and reports to fit your unique requirements.

Integration

Integration with other systems, such as accounting software and CRM systems, is essential for seamless operation. Choose software that offers easy integration with your existing systems to avoid data duplication and streamline processes.

Security

Security is paramount when dealing with sensitive financial information. Ensure that the software offers robust security features, such as data encryption, access controls, and regular security audits, to protect your data from unauthorized access.

Benefits of Using Loan Management Software

- Efficiency – It streamlines processes, reduces manual tasks, and improves overall efficiency. It allows employees to focus on more value-added activities, such as customer service and risk management.

- Accuracy – By automating processes and reducing manual intervention, loan management software helps improve accuracy in loan processing and reduces the risk of errors.

- Compliance – It helps ensure compliance with regulatory requirements by providing tools for tracking and reporting on key metrics and ensuring that loan processing practices adhere to regulations.

- Customer Experience – By streamlining processes and reducing wait times, loan management software improves the overall customer experience. Borrowers can apply for loans online, track their application status, and make payments conveniently, enhancing satisfaction and loyalty.

Read More : https://camlenio.com/blogs/best-mobile-recharge-api-provider/

How to Choose the Right Loan Management Software

- Assessing Your Needs – Start by assessing your institution’s needs and identifying the specific challenges you want to address with loan software. Consider factors such as loan volume, complexity, and regulatory requirements.

- Researching Options – Research the available loan management software options in the market. Look for software that offers the features and functionality you need, as well as good customer reviews and a track record of reliability.

- Comparing Features and Pricing – Compare the features and pricing of different loan management software solutions. Look for software that offers a good balance of features, pricing, and scalability to meet your institution’s needs now and in the future.

- Reading Reviews – Read reviews from other financial institutions that have implemented the software. Pay attention to feedback on ease of use, customer support, and overall satisfaction to make an informed decision.

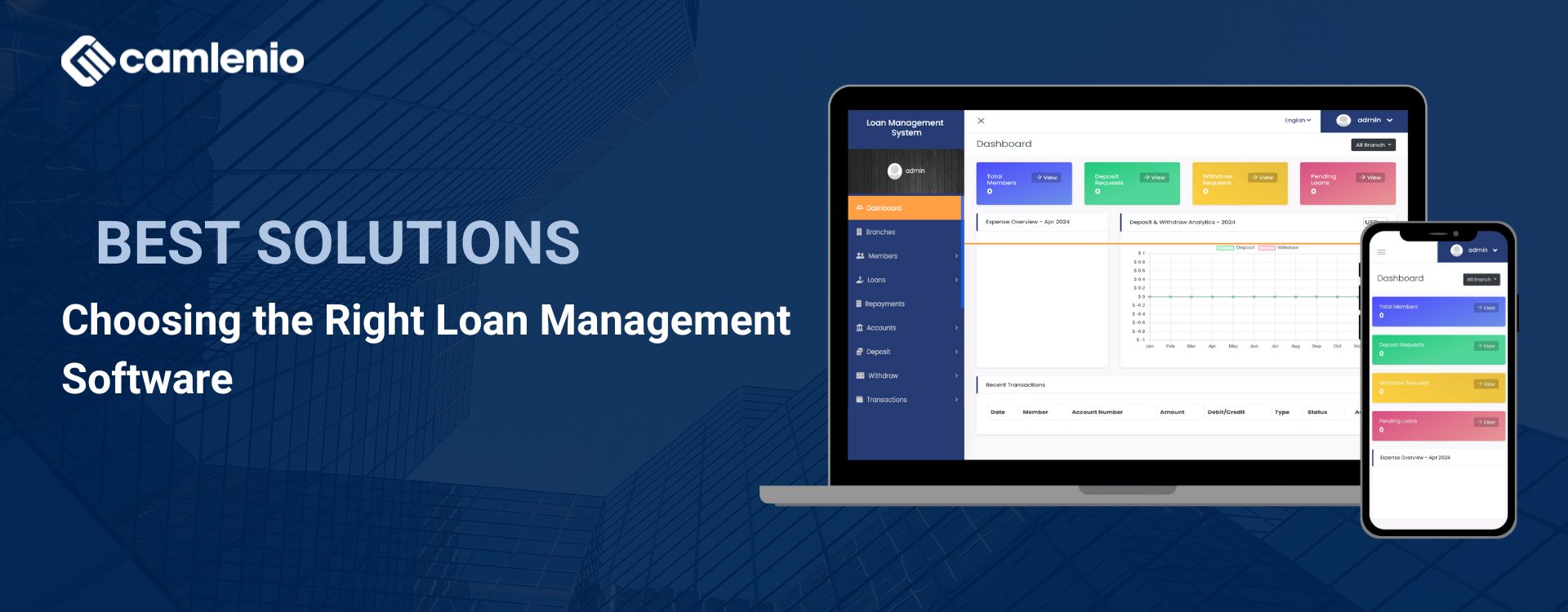

Transforming Loan Management with Camlenio

Camlenio’s Loan Management Software is revolutionizing the way financial institutions manage their loan portfolios. By automating processes, improving efficiency, and enhancing customer experience, Camlenio is helping financial institutions stay competitive in today’s dynamic market. It is a game-changer for financial institutions looking to streamline their loan processes. With its advanced features, user-friendly interface, and compliance with regulatory requirements, Camlenio is setting new standards in software.

Conclusion

loan software is crucial for financial institutions looking to streamline loan processing, improve efficiency, and enhance customer experience. By understanding the key features to look for, assessing your institution’s needs, and researching options, you can find a solution that meets your requirements and helps you achieve your goals.

FAQs

- What is loan management software?

- It is a specialized system designed to automate the loan lifecycle, from application to repayment.

- What are the key features of loan management software?

- Key features of loan management software include automation, customization, integration, and security.

- How can loan management software benefit financial institutions?

- It can improve efficiency, accuracy, compliance, and customer experience for financial institutions.

- How should financial institutions choose the right loan management software?

- Financial institutions should assess their needs, research options, compare features and pricing, and read reviews before choosing loan management software.

- Can loan management software be integrated with other systems?

- Yes, it can be integrated with other systems such as accounting software and CRM systems for seamless operation.