In today’s fast-paced digital world, businesses are constantly seeking innovative solutions to streamline their operations and enhance efficiency. One such revolutionary technology that has transformed the way businesses conduct transactions is the Aadhaar Enabled Payment System (AEPS). AEPS has emerged as a game-changer in the realm of B2B transactions, offering a secure, reliable, and efficient way for businesses to manage their financial transactions.

Table of Contents

ToggleWhat is AEPS Software?

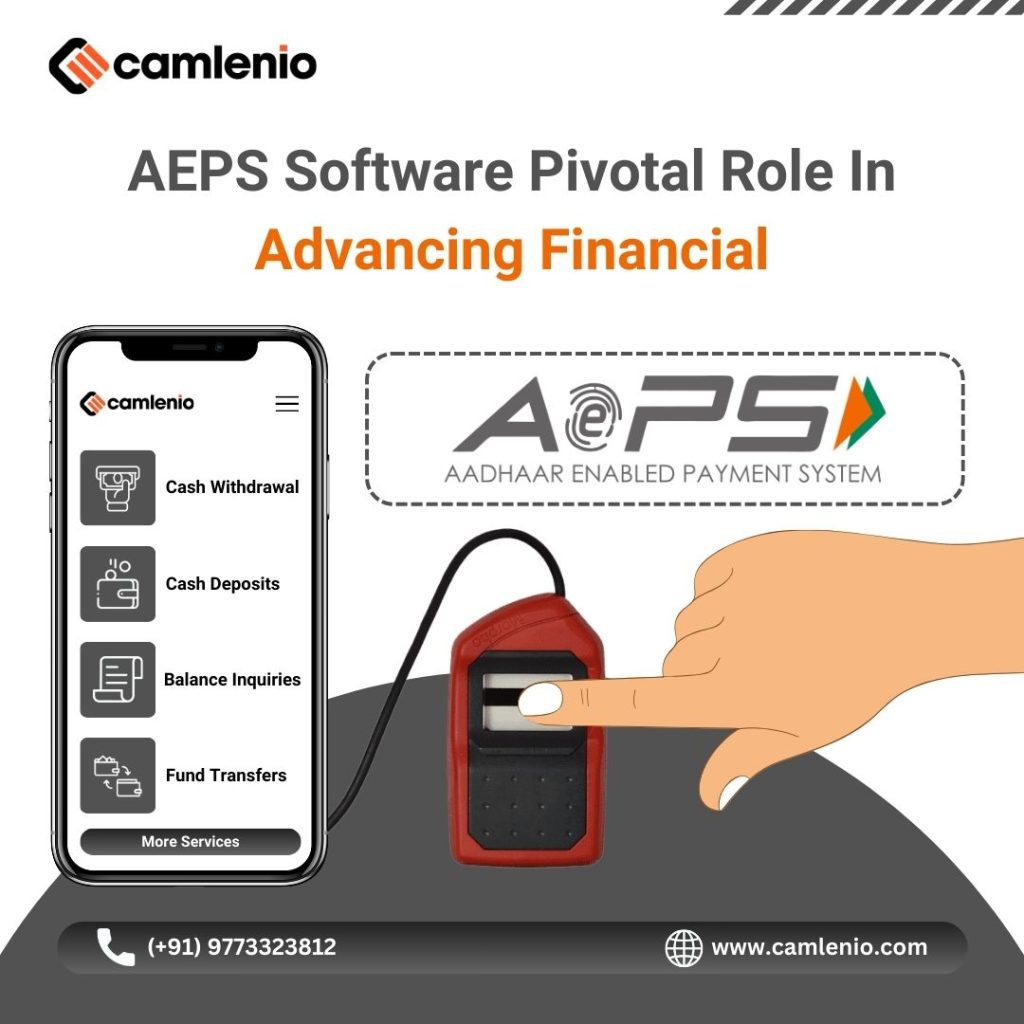

AEPS is a bank-led model that enables online interoperable financial transactions at a point of sale (PoS) through the business correspondent of any bank using the Aadhaar authentication. It allows businesses to facilitate transactions such as cash withdrawal, balance inquiry, and fund transfer using Aadhaar authentication.

Features of AEPS Software

- Aadhaar Authentication: AEPS software enables users to authenticate their identity using their Aadhaar number and biometric data (fingerprint/iris scan). This authentication is used to authorize transactions.

- Basic Banking Services: AEPS allows users to access basic banking services such as cash withdrawal, cash deposit, balance inquiry, and fund transfer using Aadhaar authentication, without the need for a debit card or ATM.

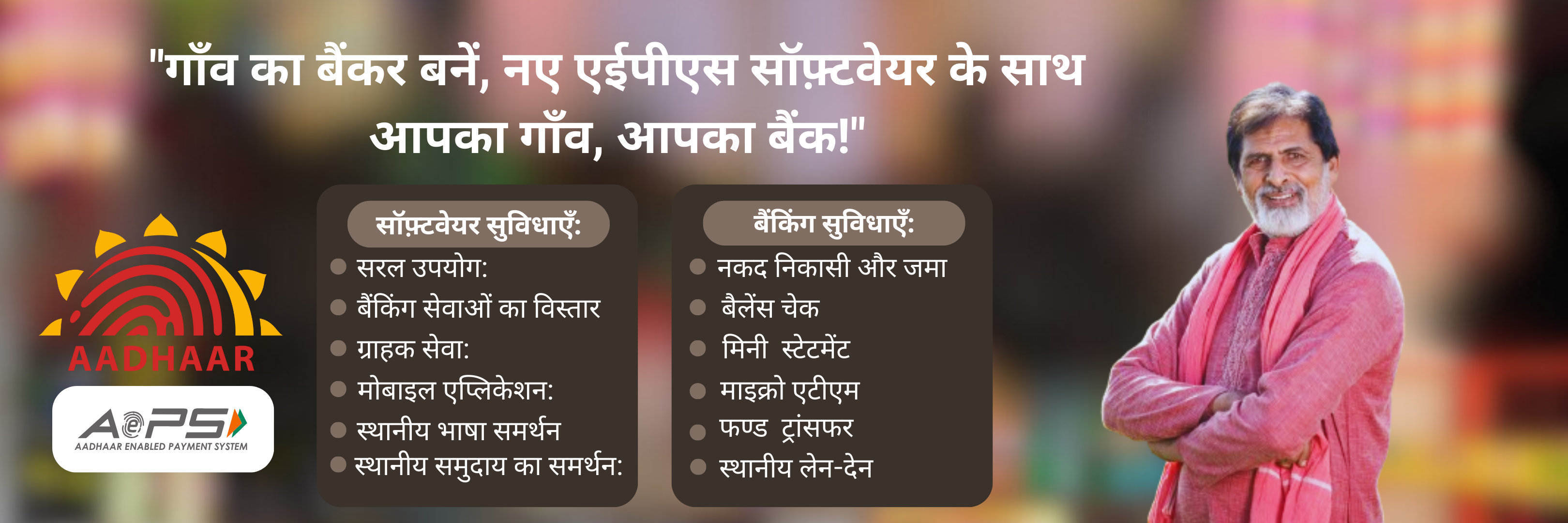

- Financial Inclusion: AEPS aims to promote financial inclusion by providing banking services to unbanked and underbanked individuals in remote areas where traditional banking infrastructure is lacking.

- Secure Transactions: AEPS transactions are secure and reliable, as they are authenticated using biometric data linked to the Aadhaar number, reducing the risk of fraud and unauthorized transactions.

- Interoperability: AEPS is interoperable across different banks and banking correspondents, allowing users to access their bank accounts and perform transactions at any AEPS-enabled outlet, regardless of the bank.

- Transaction History: AEPS software provides users with a transaction history, allowing them to track their transactions and monitor their account activity.

- Real-time Transactions: AEPS transactions are processed in real-time, allowing users to access their funds instantly and make quick transactions.

- Low-cost Transactions: AEPS transactions are cost-effective compared to traditional banking methods, making financial services more accessible to low-income individuals.

- Easy Integration: AEPS software can be easily integrated into existing banking systems, enabling banks and financial institutions to offer AEPS services to their customers.

- Government Schemes: AEPS is often used to disburse government benefits and subsidies directly to beneficiaries’ bank accounts, reducing leakages and ensuring transparency in the distribution process.

Why Choose AEPS Software for B2B Transactions?

- Security: AEPS uses Aadhaar authentication for transactions, ensuring a high level of security. With biometric authentication, AEPS minimizes the risk of fraudulent activities, making it a reliable choice for B2B transactions.

- Convenience: AEPS eliminates the need for physical cards or cash, offering a convenient way to make payments. This is especially beneficial for businesses conducting transactions in remote areas, where access to traditional banking services is limited.

- Cost-Effective: AEPS transactions are cost-effective compared to traditional banking methods. With minimal transaction fees, businesses can save on transaction costs, making AEPS an economical choice for B2B transactions.

- Real-Time Transactions: AEPS enables real-time transactions, allowing businesses to make payments instantly. This quick turnaround time is crucial for businesses that require immediate funds for their operations.

Read More : https://camlenio.com/blogs/top-10-software-development-companies-in-jaipur/

How AEPS is Transforming B2B Transactions in Jaipur

In Jaipur, AEPS has gained significant traction among businesses looking to enhance the efficiency and security of their transactions. Several AEPS software companies in Jaipur are offering innovative solutions tailored to the needs of businesses, enabling them to leverage the benefits of AEPS.

Camlenio, which offers a comprehensive AEPS solution designed to meet the unique requirements of businesses in Jaipur. Their solution provides businesses with a secure platform to conduct transactions, ensuring the confidentiality and integrity of their financial data.

Benefits of AEPS Software for Businesses in Jaipur

- Efficient Cash Management: AEPS allows businesses to manage their cash flow more efficiently, reducing the risk of cash pilferage or loss.

- Improved Financial Inclusion: AEPS has helped in improving financial inclusion in Jaipur, enabling businesses in remote areas to access banking services and conduct transactions with ease.

- Enhanced Security: With Aadhaar authentication, AEPS offers enhanced security for transactions, ensuring that businesses can conduct transactions without worrying about fraud.

- Streamlined Operations: AEPS streamlines the payment process, allowing businesses to focus on their core operations without worrying about payment delays or issues.

Conclusion

AEPS Software has emerged as a transformative technology for businesses looking to enhance the security, efficiency, and convenience of their transactions. In Jaipur, AEPS is revolutionizing B2B transactions, enabling businesses to streamline their operations and drive growth. By leveraging the benefits of AEPS, businesses in Jaipur can boost their competitiveness and position themselves for success in the digital era.