In today’s fast-paced business landscape, efficient payment systems are crucial for smooth operations. One such system that has revolutionized B2B payments is the Bharat Bill Payment System (BBPS). In this comprehensive guide, we’ll delve into the details of BBPS and how it can streamline B2B payments for your business.

What is BBPS?

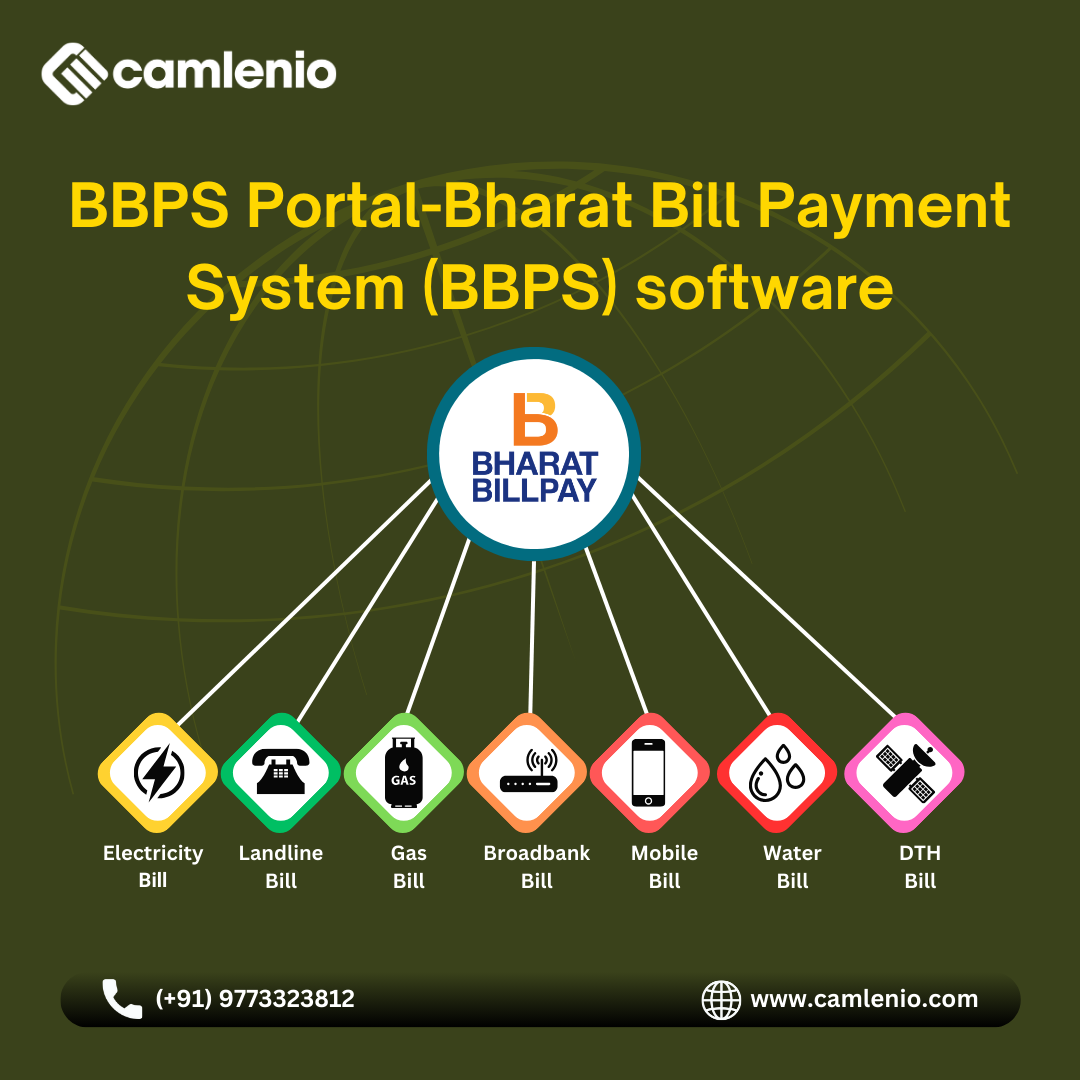

BBPS, or Bharat Bill Payment System, is an integrated online platform developed by the National Payments Corporation of India (NPCI) to facilitate the payment of bills and other recurring payments in a streamlined and efficient manner. It acts as a centralized system for consumers to pay their bills, such as electricity, water, gas, and telephone bills, as well as make payments for services like DTH (Direct-to-Home) television and broadband internet. BBPS provides a single interface for payment of different bills, making it convenient for consumers who previously had to visit multiple websites or outlets to pay various bills.

What are B2B Payments?

B2B payments, short for business-to-business payments, refer to financial transactions between two businesses. These transactions can involve the exchange of goods, services, or both, and are typically larger in scale compared to consumer transactions. B2B payments are essential for businesses to operate smoothly, allowing them to pay suppliers, vendors, and other partners for goods and services rendered. These payments can take various forms, including electronic transfers, checks, wire transfers, and virtual card payments. B2B payments often involve more complex processes and regulations than consumer payments, requiring businesses to use specialized tools and services to manage them efficiently.

BBPS – Advantages B2B Payments

- Convenience: BBPS provides a unified platform for businesses to make multiple payments, such as utility bills, insurance premiums, and taxes, in a hassle-free manner.

- Time-saving: It saves time for businesses by allowing them to make payments online, avoiding the need to visit multiple billers or make manual payments.

- Cost-effective: BBPS helps reduce transaction costs associated with traditional payment methods, such as checks or cash.

- Enhanced security: Transactions through BBPS are secure, reducing the risk of fraud or theft associated with cash payments.

- Improved record-keeping: BBPS provides businesses with digital records of their transactions, making it easier to track and manage payments.

- Accessibility: BBPS is accessible 24/7, allowing businesses to make payments at their convenience, without being constrained by banking hours.

- Compliance: BBPS ensures compliance with regulatory requirements, helping businesses avoid penalties for late or incorrect payments.

- Scalability: BBPS can handle payments of varying sizes, making it suitable for businesses of all scales, from small enterprises to large corporations.

Read More : https://camlenio.com/blogs/choosing-the-right-loan-management-software/

How Does BBPS Work?

BBPS, or Bharat Bill Payment System, is an integrated bill payment system in India that offers interoperable and accessible bill payment services to customers through a network of agents, banks, and online channels. The system functions as a centralized platform that allows users to pay their bills, such as electricity, water, gas, and phone bills, seamlessly.

To understand how BBPS works, consider a customer who wants to pay their electricity bill. They can visit a BBPS agent, bank branch, or use an online channel such as a website or mobile app. The customer provides their bill details and the payment amount to the service provider. The service provider then processes the payment through the BBPS platform.

The BBPS platform acts as an intermediary between the customer, the biller (electricity provider, in this case), and the bank or payment gateway. It validates the bill details, confirms the payment, and provides instant confirmation to the customer. The payment is then settled between the bank and the biller.

Implementing BBPS for Your Business

To start using BBPS for your B2B payments, follow these steps:

- Registration: Register your business as a BBPS agent or partner with a BBPS agent.

- Integration: Integrate BBPS APIs into your existing payment systems or use BBPS-enabled platforms.

- Training: Train your staff on using BBPS and educate your customers about the payment process.

- Testing: Conduct thorough testing to ensure that your BBPS integration is functioning correctly.

- Go Live: Once everything is in place, you can start accepting BBPS payments from your customers.

Conclusion

BBPS offers a seamless and secure way to streamline B2B payments for your business. By adopting BBPS, you can improve efficiency, reduce costs, and enhance the overall payment experience for your customers. Embrace the power of BBPS and take your B2B payments to the next level!

in dignissimos assumenda ut dolores. et sint est molestias et molestiae dolor. sint voluptatem similique dolorem quia alias non.