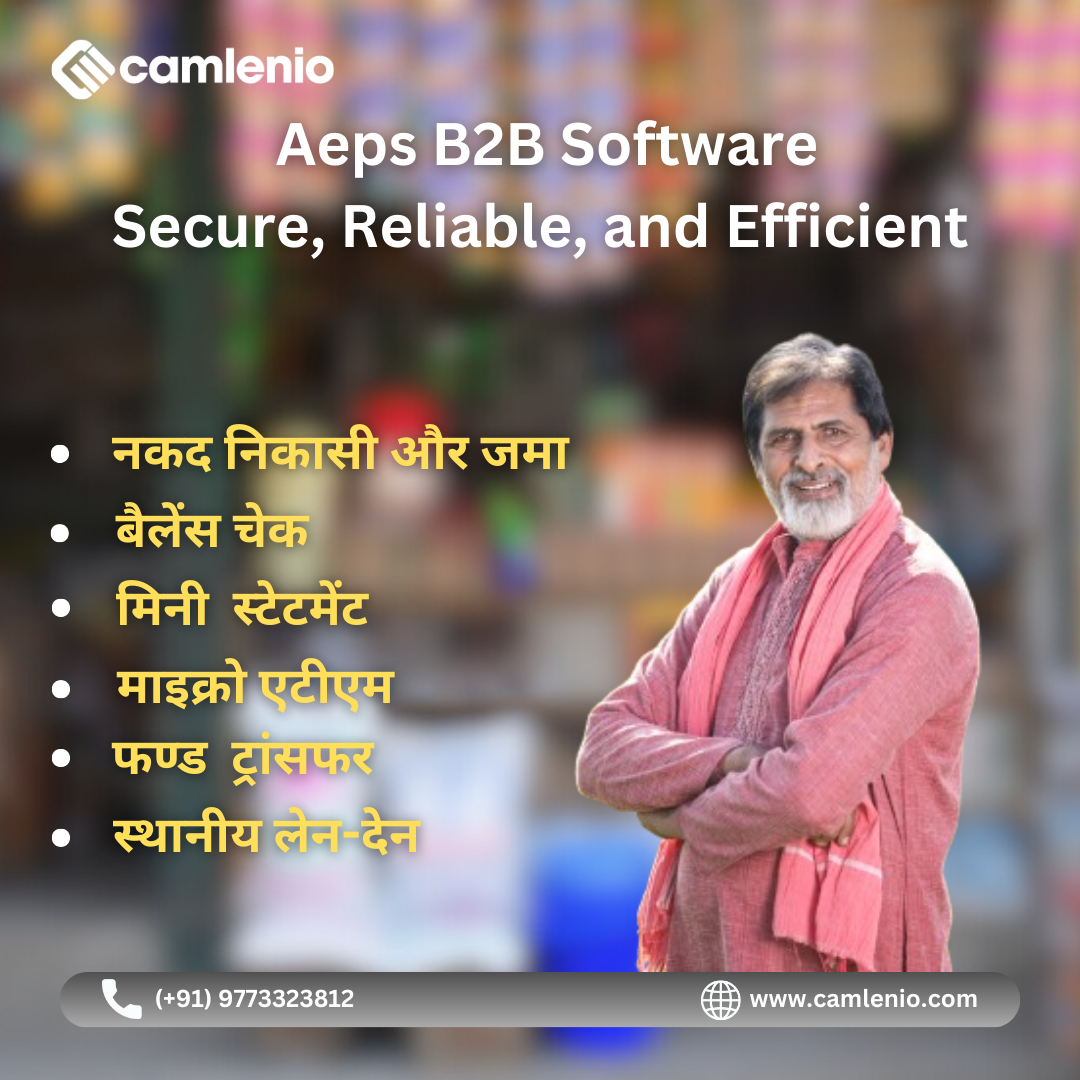

AEPS B2B Software: Your Payment Gateway to Business Success

In the digital age, businesses are constantly seeking innovative solutions to streamline their operations and improve efficiency. One such solution that has gained prominence is AEPS B2B software, which serves as a payment gateway to business success. This article explores the key aspects of AEPS B2B software, its benefits, features, and how it can revolutionize payment processes for businesses across industries.

What is AEPS B2B Software?

It stands for Aadhaar Enabled Payment System Business-to-Business software. It is a digital payment solution that leverages the Aadhaar infrastructure to facilitate secure, real-time transactions between businesses. It enables businesses to make payments, receive payments, and manage their financial transactions seamlessly.

How does AEPS B2B Software work?

It works by authenticating transactions using the Aadhaar number linked to the individual’s bank account. It eliminates the need for traditional banking methods such as checks or physical cash. Businesses can initiate transactions using AEPS software, and the payment is directly credited or debited from the respective bank accounts.

Benefits of using AEPS B2B Software

- Enhanced security: Transactions are authenticated using Aadhaar biometric data, ensuring secure payments.

- Real-time transactions: It enables instant payments, improving cash flow management.

- Cost-effective: Eliminates the need for physical infrastructure and reduces transaction costs.

- Accessibility: Can be accessed from anywhere, facilitating remote transactions.

- Integration: Can be seamlessly integrated with existing financial systems for efficient operations.

Features of AEPS B2B Software

- Aadhaar authentication: Uses Aadhaar biometric data for secure transactions.

- Transaction history: Provides a detailed record of all transactions for easy tracking.

- Multi-bank support: Supports transactions across multiple banks for convenience.

- API integration: Can be integrated with other software systems for enhanced functionality.

- Customization: Offers customizable features to meet the specific needs of businesses.

Read More : https://camlenio.com/blogs/camlenios-fintech-software-services/

Industries that can benefit from AEPS B2B Software

- Retail: Facilitates seamless transactions for retail businesses, improving customer experience.

- E-commerce: Enables secure online payments for e-commerce platforms, reducing payment processing time.

- Banking: Streamlines banking operations, improving efficiency and customer service.

- Healthcare: Enhances payment processes in the healthcare sector, ensuring timely payments to healthcare providers.

How to choose the right AEPS B2B Software for your business

- Evaluate your business needs: Determine the specific requirements of your business to find a software solution that meets your needs.

- Research available options: Conduct thorough research to find reputable AEPS software providers.

- Consider integration capabilities: Choose a software solution that can be easily integrated with your existing systems.

- Cost-effectiveness: Consider the cost of the software and ensure it fits within your budget.

- Security: Ensure the software offers robust security features to protect your transactions.

Implementation and integration of AEPS B2B Software

- Identify key stakeholders: Involve all relevant stakeholders in the implementation process.

- Conduct training: Provide training to your employees to ensure they understand how to use the software effectively.

- Monitor performance: Continuously monitor the performance of the software to identify any issues and address them promptly.

Best practices for using AEPS B2B Software

- Regularly update the software to ensure it remains secure and functional.

- Keep track of your transactions to maintain accurate financial records.

- Maintain communication with your software provider to address any issues or concerns promptly.

Future trends in AEPS B2B Software

- Increased adoption: More businesses are expected to adopt AEPS software to streamline their payment processes.

- Advanced security features: It is expected to incorporate advanced security features to protect against fraud.

- Integration with emerging technologies: It may integrate with technologies such as blockchain and AI to enhance functionality.

Conclusion

AEPS B2B software offers a plethora of benefits for businesses looking to streamline their payment processes. From enhanced security to real-time transactions, AEPS software is revolutionizing the way businesses manage their finances. By choosing the right software solution and implementing best practices, businesses can leverage AEPS B2B software to achieve greater efficiency and success.

FAQs

- Q: Can AEPS software be integrated with existing banking systems?

- A: Yes, AEPS software can be seamlessly integrated with existing banking systems for enhanced functionality.

- Q: Is AEPS B2B software secure?

- A: Yes, AEPS software uses Aadhaar biometric data for authentication, ensuring secure transactions.

- Q: Can AEPS software be customized to meet specific business needs?

- A: Yes, AEPS software offers customizable features to meet the specific needs of businesses.

- Q: How can businesses benefit from using AEPS software?

- A: Businesses can benefit from AEPS software by improving transaction efficiency, reducing costs, and enhancing security.

- Q: What industries can benefit from AEPS software?

- A: Industries such as retail, e-commerce, banking, and healthcare can benefit from AEPS software.