Introduction

The year 2024 has witnessed a significant revolution in the payment landscape, with digital payment systems playing a crucial role in transforming how people make transactions. One such transformative system is the Bharat Bill Payment System (BBPS), which has emerged as a cornerstone of this revolution. This article explores the evolution of payment systems in India, introduces the BBPS, discusses its role in simplifying bill payments, examines key developments in 2024, and outlines BBPS’s role in the ongoing payment revolution.

Evolution of Payment Systems in India

India has seen a gradual shift from traditional cash-based transactions to digital payment methods over the years. The introduction of digital payment systems such as Unified Payments Interface (UPI), Immediate Payment Service (IMPS), and National Electronic Funds Transfer (NEFT) has revolutionized the payment ecosystem. Despite these advancements, there was a need for a unified system that could streamline bill payments across various service providers, leading to the introduction of the Bharat Bill Payment System (BBPS).

Read More : https://camlenio.com/blogs/cab-booking-software-for-your-business-in-2024/

What is the Bharat Bill Payment System (BBPS)?

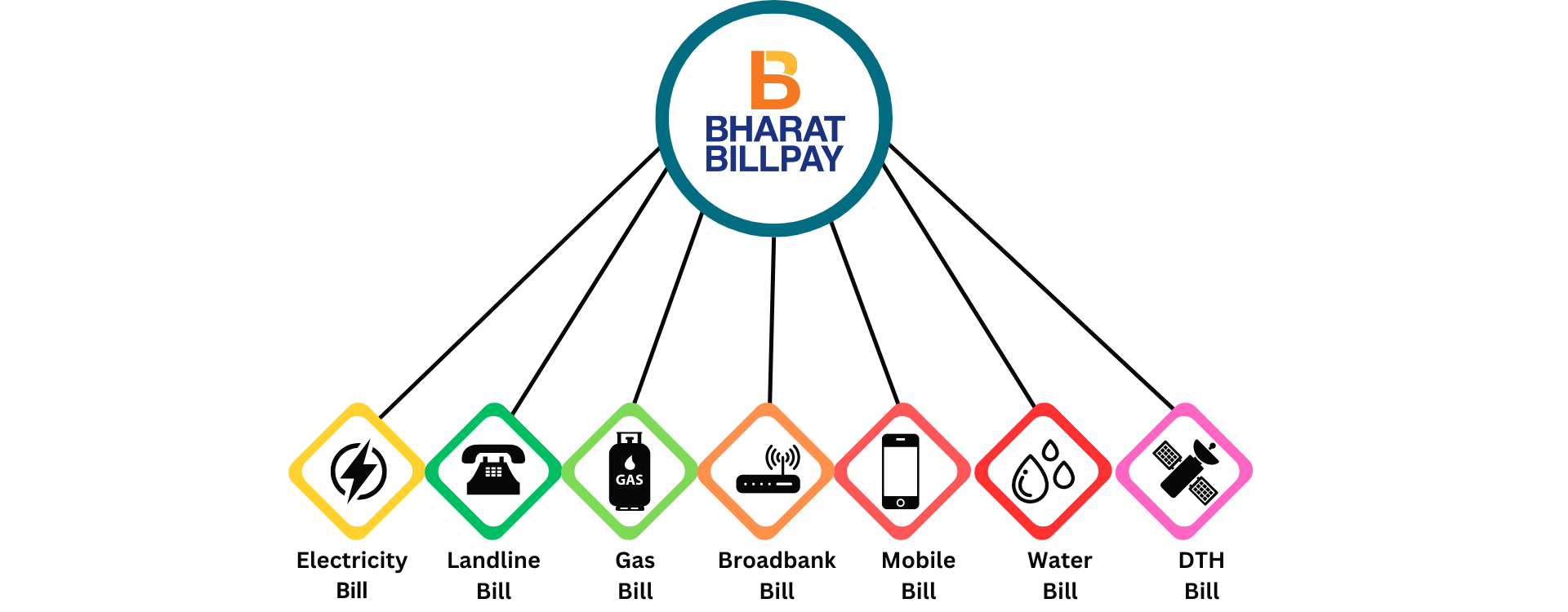

The Bharat Bill Payment System (BBPS) is an integrated bill payment system that offers interoperable and accessible bill payment services to customers through a network of agents. It allows customers to pay bills such as electricity, water, gas, telephone, and DTH services in a convenient and secure manner. BBPS is operated by the National Payments Corporation of India (NPCI) and is regulated by the Reserve Bank of India (RBI).

BBPS: Simplifying Bill Payments

BBPS simplifies bill payments by providing a single platform for consumers to pay bills from multiple service providers. Unlike traditional methods where consumers have to visit multiple websites or outlets to pay bills, BBPS allows them to make payments through a single interface. This not only saves time and effort but also reduces the chances of errors in bill payments.

BBPS in 2024: Key Developments

In 2024, BBPS has seen several key developments aimed at enhancing its functionality and user experience. One of the major developments is the integration of BBPS with popular payment apps and platforms, making it more accessible to a wider audience. Additionally, BBPS has introduced new features such as recurring payments, bill reminders, and loyalty programs to incentivize customers to use the platform regularly.

BBPS’s Role in the Payment Revolution

BBPS is playing a significant role in the payment revolution by offering a seamless and secure platform for bill payments. Its integration with various payment apps and platforms has made it easier for consumers to adopt digital payment methods. Furthermore, BBPS’s innovative features and user-friendly interface have set a benchmark for other bill payment systems, driving further innovation in the payment ecosystem.

Challenges and Opportunities

While BBPS has been successful in simplifying bill payments, it faces challenges such as security concerns, interoperability issues, and competition from other payment systems. However, these challenges also present opportunities for BBPS to innovate and improve its services. By addressing these challenges, BBPS can further strengthen its position in the payment industry and offer more value to its customers.

Future Outlook

Looking ahead, BBPS is expected to continue its growth trajectory, with more service providers and consumers embracing the platform. The integration of new technologies such as artificial intelligence (AI) and blockchain is likely to further enhance BBPS’s capabilities and security. With its commitment to innovation and customer satisfaction, BBPS is well-positioned to shape the future of bill payments in India.

Conclusion

In conclusion, the Bharat Bill Payment System (BBPS) has emerged as a key player in 2024’s payment revolution, offering a convenient and secure platform for bill payments. Its innovative features, user-friendly interface, and commitment to customer satisfaction have made it a preferred choice for millions of consumers. As BBPS continues to evolve and adapt to changing market dynamics, it is poised to redefine the payment landscape in India.

FAQs

- What is the Bharat Bill Payment System (BBPS)?

- BBPS is an integrated bill payment system that offers interoperable and accessible bill payment services to customers through a network of agents.

- How does BBPS simplify bill payments?

- BBPS provides a single platform for consumers to pay bills from multiple service providers, saving time and effort.

- What are some key developments in BBPS in 2024?

- Integration with popular payment apps, introduction of new features such as recurring payments and bill reminders.

- How is BBPS contributing to the payment revolution?

- By offering a seamless and secure platform for bill payments, integrating with various payment apps and platforms.

- What are the future prospects of BBPS?

- Continued growth, integration of new technologies like AI and blockchain

hello!,I like your writing so a lot! share we be iin contact more approximately your post on AOL?

I require a specialist iin this house to resolve my problem.

Maybe that is you! Taking a look ahead to look you.

Also visit my website; Casimira

Thank you for your kind words! I’m glad to hear that you appreciate my writing. I’d be happy to help you with your needs. Feel free to get in touch with me through my website for any assistance you require. Looking forward to hearing from you soon!