Introduction

AEPS (Aadhaar Enabled Payment System) has revolutionized the way banking and financial transactions are conducted in India. It leverages the Aadhaar authentication to facilitate banking transactions, making financial services accessible to every Indian citizen. In this article, we will delve into the top 10 AEPS software providers in India for 2024, highlighting their features, benefits, and why they stand out in the market.

What is AEPS Software?

AEPS (Aadhaar Enabled Payment System) software is a revolutionary financial technology solution that facilitates banking transactions through Aadhaar authentication. Developed to enhance financial inclusion, AEPS allows individuals to access various banking services such as cash deposits, withdrawals, balance inquiries, and fund transfers using their unique Aadhaar number and biometric data. This software is particularly beneficial in rural and remote areas, where traditional banking infrastructure is limited. By leveraging the AEPS platform, banks and financial institutions can provide seamless and secure banking services to the unbanked and underbanked populations, thereby fostering greater financial accessibility and empowerment.

Key Features of AEPS Software Providers

- Interoperability: Enables transactions across different banks.

- Secure Transactions: Utilizes biometric authentication.

- Accessibility: Available in remote areas through Business Correspondents.

Benefits of Using AEPS Software

Convenience and Accessibility

AEPS makes banking services accessible to people in rural and remote areas, reducing the need for physical bank branches.

Financial Inclusion

It promotes financial inclusion by bringing banking services to the unbanked and underbanked populations of India.

Security and Transparency

The use of biometric authentication ensures secure transactions and reduces fraud, while transaction logs provide transparency.

Criteria for Choosing the Best AEPS Software Provider

User-Friendliness

The software should be easy to navigate for both customers and operators.

Security Measures

Robust security features are essential to protect user data and prevent fraudulent activities.

Customer Support

Responsive customer support can help resolve issues quickly and efficiently.

Pricing

Affordable pricing plans can make AEPS solutions accessible to small and medium-sized enterprises.

Read More : https://camlenio.com/blogs/domestic-money-transfer-solutions/

Top 10 AEPS Software Providers in India 2024

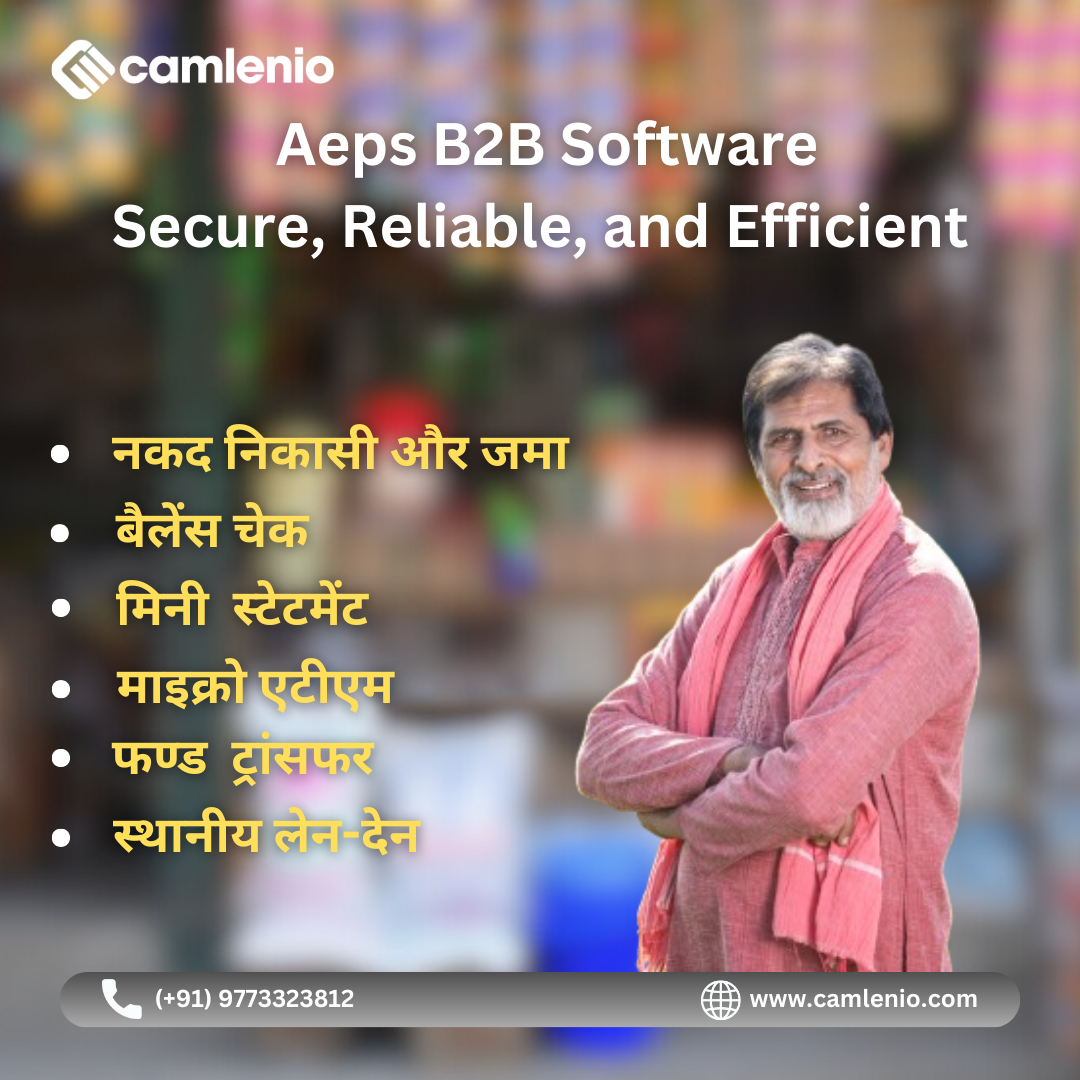

1. Camlenio Software pvt ltd

Camlenio is a software company that specializes in providing AEPS (Aadhaar Enabled Payment System) software solutions. AEPS is an Indian payment system that allows customers to carry out financial transactions on a micro-ATM (Automated Teller Machine) by using their Aadhaar number and fingerprint verification. Camlenio’s software likely facilitates these transactions, making it easier for businesses and financial institutions to offer AEPS services to their customers.

2. Spice Money

Spice Money is a financial services company based in India that offers a range of services, including Aadhaar Enabled Payment System (AEPS) software. AEPS is a payment service that allows customers to access their bank accounts and perform basic banking transactions using their Aadhaar number and biometric authentication. This service is particularly useful for people who may not have easy access to traditional banking services.

Spice Money’s AEPS software enables businesses to offer AEPS services to their customers, such as cash withdrawal, balance inquiry, and funds transfer. The software is designed to be user-friendly and secure, ensuring that transactions are processed efficiently and safely.

3. Pay nearby

PayNearby is a financial technology company based in India that focuses on providing digital financial and banking services to the underserved and unbanked population in the country. The company offers a range of services, including Aadhaar Enabled Payment System (AEPS), which allows customers to access basic banking services using their Aadhaar number and fingerprint authentication.

With PayNearby’s AEPS software, customers can perform various banking transactions such as cash withdrawal, balance inquiry, and fund transfers at nearby retail outlets that are part of the PayNearby network. This service helps to bring banking services closer to people in rural and remote areas who may not have easy access to traditional bank branches.

4. RapiPay

RapiPay is a company that specializes in providing Aadhaar Enabled Payment System (AEPS) software solutions. AEPS is a system introduced by the Government of India to allow bank customers to use their Aadhaar number and biometric authentication instead of traditional banking methods for various financial transactions.

RapiPay’s software likely facilitates AEPS transactions, enabling users to carry out banking activities such as cash withdrawal, balance inquiry, fund transfer, and more, using Aadhaar authentication at micro-ATMs or designated banking points. These services are particularly beneficial for people in remote areas or those without easy access to traditional banking services.

5. Eko India Financial Services Pvt. Ltd.

Eko India is known for its customer-centric approach. It offers a wide range of banking services through its AEPS platform, catering to the diverse needs of customers. Eko India Financial Services Pvt. Ltd. is a company based in India that offers financial services, particularly focused on digital financial solutions. India has partnered with various banks and financial institutions to offer its services and has been recognized for its innovative approach to financial inclusion in India.

6. Bankit

Bankit is a reliable AEPS service provider known for its secure transactions. It has a strong presence in rural areas, making banking services accessible to all. Bankit is a financial technology company that provides banking and payment solutions. They offer a range of services, including digital banking, payment processing, and financial management tools. Bankit’s platform is designed to help businesses and individuals manage their finances more efficiently and securely. They may also offer services such as mobile banking apps, online payment gateways, and other digital financial solutions.

7. NamoPay

NamoPay is a company that provides AEPS (Aadhaar Enabled Payment System) software solutions. AEPS is a system developed by the National Payments Corporation of India (NPCI) that allows people to carry out financial transactions on a micro-ATM by using their Aadhaar number and fingerprint. NamoPay likely offers software that enables businesses to integrate AEPS functionality into their operations, allowing them to offer services such as cash withdrawals, balance inquiries, and fund transfers to their customers using Aadhaar authentication.

8. Fino Payments AePS

Fino Payments‘ Aadhaar Enabled Payment System (AePS) is a revolutionary financial service designed to provide seamless banking and payment solutions to underserved and unbanked populations in India. By leveraging the Aadhaar biometric authentication, Fino Payments AePS enables customers to conduct a variety of financial transactions, such as cash withdrawals, balance inquiries, and fund transfers, directly from their Aadhaar-linked bank accounts. This service brings banking accessibility to the fingertips of millions, especially in rural and remote areas, promoting financial inclusion and empowering individuals with secure and convenient banking options.

9. Airtel Payments AePS

Airtel Payments Bank offers the Aadhaar Enabled Payment System (AePS), a revolutionary banking service designed to provide seamless financial transactions for individuals, especially in rural and semi-urban areas. AePS leverages the Aadhaar authentication to enable customers to perform basic banking activities such as cash withdrawals, balance inquiries, and fund transfers using their Aadhaar number and fingerprint verification. This service bridges the gap between the unbanked population and formal banking systems, ensuring financial inclusion and ease of access to banking services.

10.Ezeepay

Ezeepay is a company that provides AEPS (Aadhaar Enabled Payment System) software solutions. AEPS is an innovative payment service that allows customers to use their Aadhaar number and fingerprint for transactions, making it a secure and convenient way to access banking services.

Ezeepay’s software enables businesses to offer AEPS services to their customers, allowing them to withdraw cash, deposit funds, and perform other banking transactions using their Aadhaar details. This can be particularly useful in areas where traditional banking services are limited or inaccessible.

Future of AEPS Software in India

The Aadhaar Enabled Payment System (AEPS) has emerged as a transformative force in India’s financial landscape, revolutionizing the way banking and financial services reach the masses. AEPS leverages the unique identification number issued by the government, known as Aadhaar, to facilitate financial transactions securely and efficiently. This system has been particularly instrumental in bridging the gap between traditional banking services and the unbanked or underbanked population, providing them with access to a range of financial services through Aadhaar authentication. As India continues its journey towards becoming a digitally empowered economy, AEPS is poised to play a pivotal role in driving financial inclusion and fostering digital transactions across the country.

How to Choose the Right AEPS Provider for Your Needs

Assess Your Requirements

Determine your specific needs and what features are most important for your business.

Compare Features

Look at the features offered by different providers and see which ones align with your requirements.

Read Reviews and Testimonials

Customer reviews and testimonials can provide insights into the reliability and effectiveness of the software.

Conclusion

Choosing the right AEPS software providers is crucial for ensuring seamless and secure transactions. By evaluating your needs and comparing the features of different providers, you can find the perfect solution for your business. The top 10 AEPS software providers listed in this article offer a range of features and benefits that cater to various requirements, ensuring you can find the right fit.

FAQs

1. What is AEPS and how does it work? AEPS is a banking service that allows transactions using Aadhaar authentication. It works by linking the customer’s Aadhaar number with their bank account and using biometric data for authentication.

2. How can I benefit from using AEPS software? AEPS software provides convenience, financial inclusion, and secure transactions, especially in rural and remote areas.

3. Are AEPS transactions secure? Yes, AEPS transactions are secure due to the use of biometric authentication and robust security measures implemented by the software providers.

4. How do I choose the best AEPS software provider? Consider factors such as user-friendliness, security measures, customer support, and pricing when choosing an AEPS software provider.

5. What are the costs associated with AEPS software? The costs can vary based on the provider and the features offered. It’s important to compare pricing plans to find one that fits your budget.

Excellent article. I am experiencing some of these issues as well..

Visit my web page; خرید بک لینک

Appreciation to my father who told me on the topic of this

webpage, this website is actually amazing.

Yes yes yes! Trying out new stuff thanks to samples has been amazing.

So excited to see what’s next in the mail. And yeah, it really helps in making smarter choices before I buy.

Absolutely a no-brainer!

https://briansclub.ws/

Have you ever considered about including a little bit more than just your articles?

I mean, what you say is valuable and everything.

But think of if you added some great visuals or video clips to give

your posts more, “pop”! Your content is excellent but

with images and videos, this website could certainly be one of the very best in its field.

Very good blog!

Take a look at my web site … bclub. bclub cc

https://briansclubs.kz

No matter if some one searches for his required thing, thus he/she wishes to be available that in detail, thus that thing is maintained over here.

my web page: bclub. bclub cc

You are so cool! I don’t believe I’ve read through a

single thing like this before. So nice to find someone

with original thoughts on this topic. Seriously..

thanks for starting this up. This website is one thing that

is needed on the internet, someone with some originality!

Here is my site; blackstash

https://briansclubs.live

I do not even know how I ended up here, but I

thought this post was great. I do not know who you are but certainly you’re going to a famous

blogger if you are not already 😉 Cheers!

Here is my webpage: briansclub dumps

https://briansclub.be

I just couldn’t leave your website prior to

suggesting that I really enjoyed the standard information an individual provide to your guests?

Is gonna be back frequently to check out new posts

my page … brians club

Thanks veryy interesting blog! https://Www.waste-ndc.pro/community/profile/tressa79906983/

Thanks very interesting blog! https://Www.waste-ndc.pro/community/profile/tressa79906983/

The way an adept sex crimes attorney approaches each case shows just how much dedication they have for their clients