In today’s rapidly evolving digital landscape, financial inclusion has become a key priority for governments and financial institutions worldwide. Aadhaar Enabled Payment System is one such initiative in India that aims to empower individuals by providing them with easy access to banking services through their Aadhaar number. In this blog post, we’ll delve into the basics of AePS, its features, benefits, and how it is revolutionizing the way people transact in India.

What is Aeps ?

Aadhaar-enabled Payment System is a revolutionary banking infrastructure that leverages Aadhaar, India’s biometric identity system, to facilitate financial transactions. Introduced by the National Payments Corporation of India (NPCI), AePS allows individuals to conduct banking transactions through Aadhaar authentication at Micro ATMs. These Micro ATMs are essentially Point of Sale (PoS) terminals equipped with biometric scanners, enabling users to access various banking services such as cash withdrawal, balance inquiry, fund transfers, and more, without the need for a physical debit card or a visit to a bank branch.

Benefits of Aeps

- Accessibility: AePS brings banking services closer to the doorstep of millions of Indians, especially those residing in remote and rural areas where traditional banking infrastructure is limited. With Micro ATMs deployed at local kirana stores, post offices, and village councils, individuals can access basic financial services conveniently.

- Inclusivity: One of the primary objectives of AePS is to include the marginalized sections of society into the formal financial system. By linking banking services to Aadhaar, which has extensive coverage across the population, Aadhaar Enabled Payment System ensures that even those without traditional identity documents can participate in the financial ecosystem.

- Cost-effectiveness: AePS transactions are typically more cost-effective compared to traditional banking methods. Since they operate on existing infrastructure and utilize biometric authentication, the operational costs are lower, making financial services more affordable for both customers and service providers.

- Security: AePS Biometric authentication adds an extra layer of security to transactions, reducing the risks associated with identity theft and fraud. By authenticating users based on their unique fingerprints or iris scans, AePS enhances the integrity of financial transactions, fostering trust among users.

- Empowerment of Micro-entrepreneurs: AePS not only benefits consumers but also empowers micro-entrepreneurs in rural areas. Local shopkeepers and business owners serving as AePS agents earn commissions for facilitating transactions, creating additional sources of income and stimulating economic activity at the grassroots level.

- Firebase software: Firebase is primarily known as a mobile and web application development platform. It offers various services such as authentication, real-time database, cloud storage, cloud functions, hosting, and more, all of which are designed to help developers build high-quality apps quickly and efficiently.

Also Read : https://camlenio.com/blogs/the-power-of-flutter/

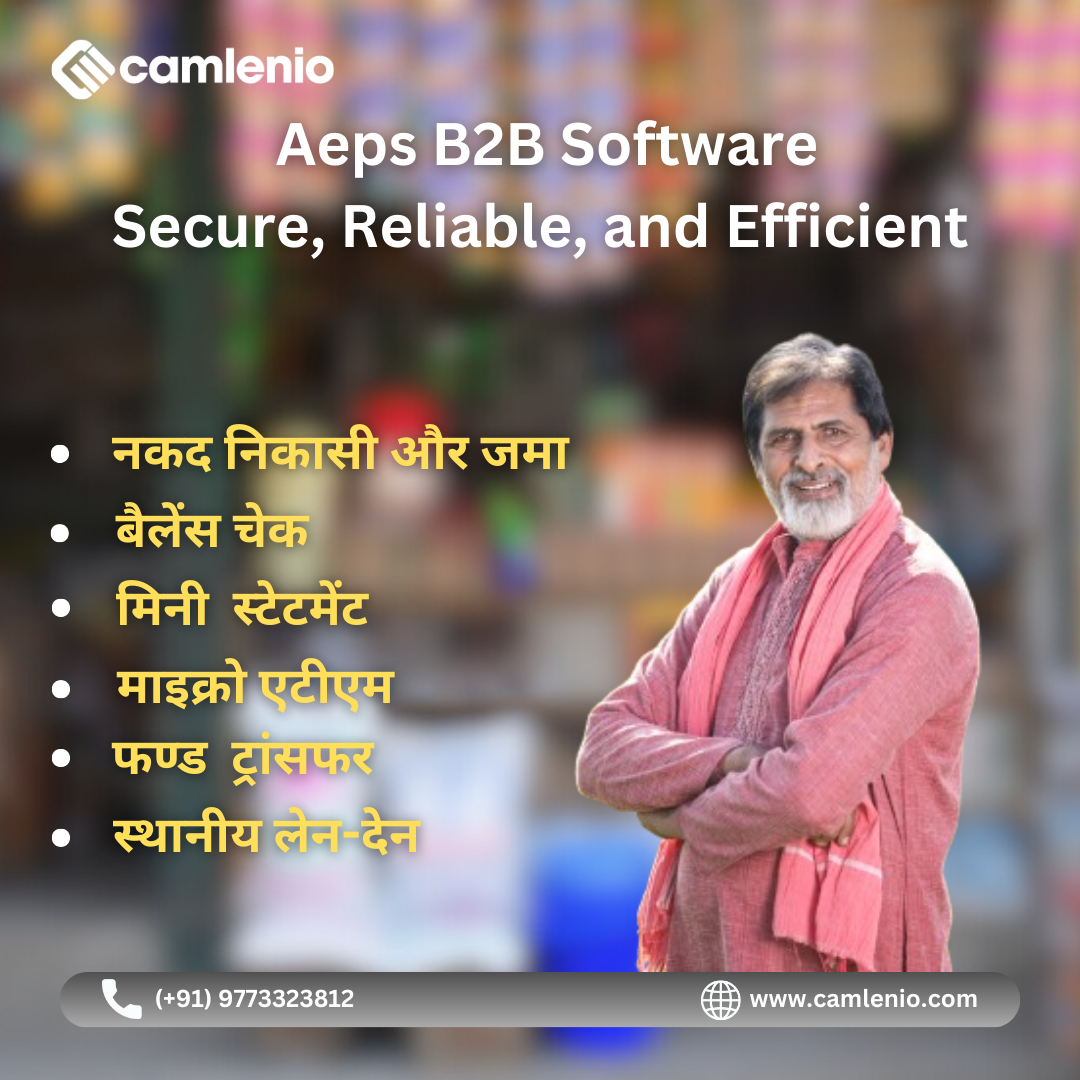

Aadhaar Enabled Payment System (AEPS) offers various services

- Mini Statement: Users can request a mini statement of their recent transactions, including details such as date, time, and amount.

- Aadhaar Pay: This service allows merchants to accept payments from customers using Aadhaar authentication. Customers can link their Aadhaar number to their bank account and make payments securely.

- AEPS Payout: Aadhaar Enabled Payment System facilitates cash withdrawals and balance inquiry through Business Correspondents (BCs) or Micro ATMs using Aadhaar authentication.

- Cash Withdrawals: Users can withdraw cash from their bank accounts linked to their Aadhaar number through AEPS-enabled devices.

- Cash Deposits: It enables users to deposit cash into their bank accounts through BCs or Micro ATMs using Aadhaar authentication.

- Fund Transfers: It supports inter-bank fund transfers, allowing users to transfer money from their bank account to another bank account using Aadhaar authentication.

- Balance Inquiries: Users can check the balance in their bank accounts linked to their Aadhaar number through AEPS-enabled devices.

Conclusion:

Aadhaar-enabled Payment System has emerged as a transformative force in India’s journey towards financial inclusion. By leveraging Aadhaar biometrics and existing infrastructure, It has revolutionized access to banking services, particularly for the unbanked and underbanked segments of society. While challenges remain, the widespread adoption and continued development of AePS hold immense promise for empowering individuals, driving economic growth, and fostering inclusive development across the nation. As India progresses on its path towards a digital economy, It stands as a beacon of hope, promising a more inclusive and prosperous future for all.

Awesome 👍