In recent years, India has witnessed a significant transformation in the way bill payments are made, thanks to the introduction of the Bharat Bill Payment System (BBPS). BBPS has revolutionized bill payments by offering a one-stop platform for consumers to pay their bills conveniently, securely, and in a timely manner. This system has not only streamlined the bill payment process but has also brought about a host of benefits for both consumers and billers.

Introduction

The Bharat Bill Payment System (BBPS) has emerged as a significant innovation in India’s fintech landscape, revolutionizing the way bill payments are processed in the country. Introduced by the National Payments Corporation of India (NPCI), BBPS is a centralized payment platform that enables consumers to pay their bills seamlessly through a single interface. This article explores the key features, benefits, and impact of BBPS on the fintech ecosystem in India.

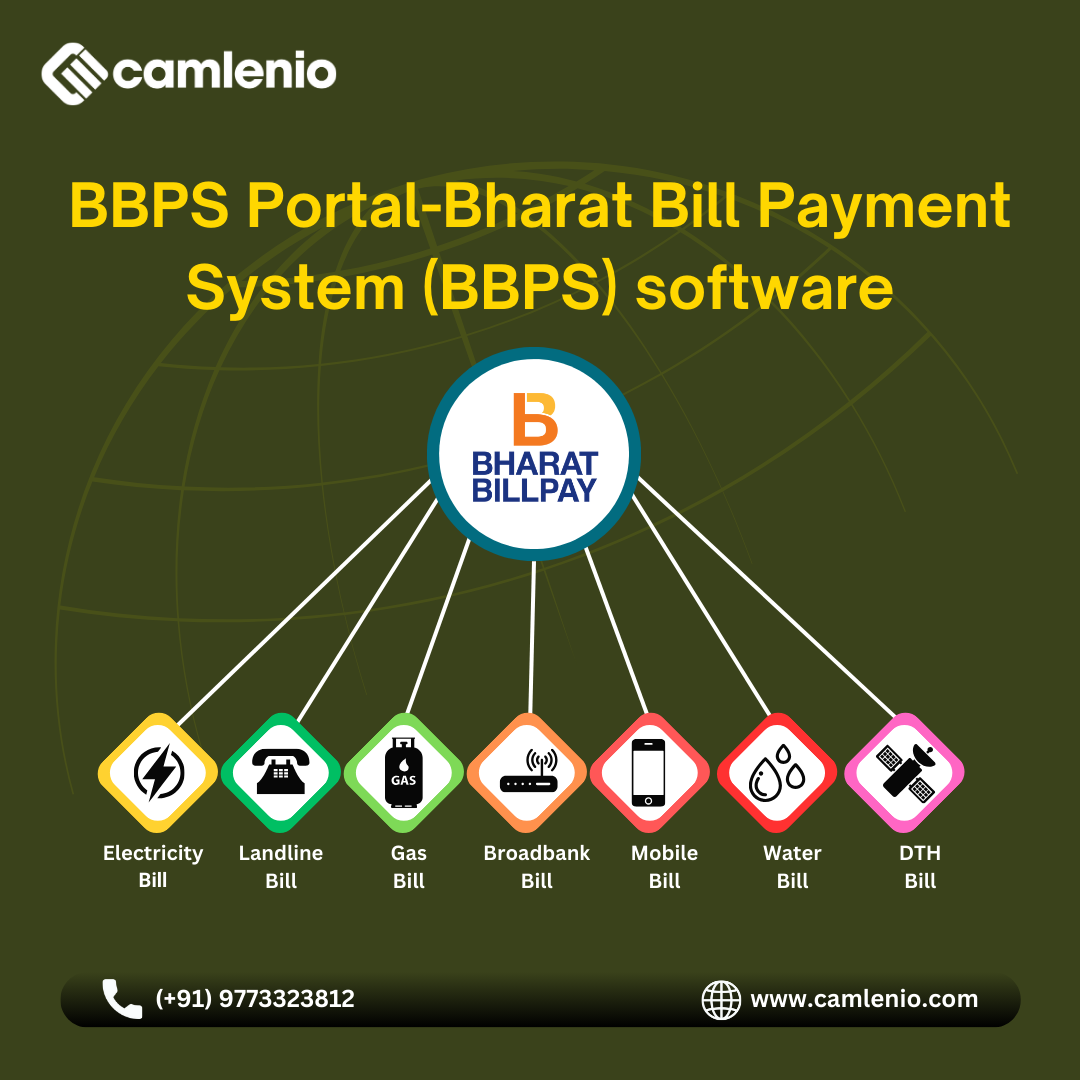

BBPS is an integrated bill payment system that offers interoperable and accessible bill payment services to customers across India. It functions as a one-stop solution for all types of bill payments, including electricity, water, gas, telecom, and DTH services, among others. The system operates on a centralized infrastructure that connects billers (service providers) and payment service providers (PSPs) through a network of BBPS operating units (BOUs).

Read More : https://camlenio.com/blogs/mobile-recharge-services/

Key Features of BBPS

- Centralized Payment Platform: BBPS provides a centralized platform that facilitates the collection, processing, and settlement of bill payments for various services.

- Multiple Payment Channels: Customers can make payments through a wide range of channels, including online portals, mobile apps, ATMs, kiosks, and bank branches.

- Biller Agnostic Platform: BBPS is biller agnostic, which means it supports bill payments for multiple billers across different sectors, eliminating the need for consumers to visit multiple websites or outlets for bill payment.

- Real-time Payment Confirmation: BBPS ensures real-time confirmation of payments, providing customers with instant receipts and notifications.

- Dispute Resolution Mechanism: The system provides a robust dispute resolution mechanism to address any payment-related issues or discrepancies.

Services of BBPS

- Electricity Bill Payments

Electricity bill payments constitute a significant portion of household expenses for most Indians. With BBPS, consumers can pay their electricity bills from various providers across the country through a single platform. This streamlines the payment process, reduces errors, and ensures timely payments, thus avoiding late fees and service interruptions.

- Water Bill Payments

Similar to electricity bills, water bill payments are essential for urban and rural households. It allows consumers to pay their water bills seamlessly, ensuring efficient water supply management and revenue collection for water authorities. This service enhances transparency and accountability in water billing processes.

- LPG Gas Payments

Liquefied Petroleum Gas (LPG) is a vital cooking fuel for millions of households in India. It facilitates the payment of LPG gas bills, enabling consumers to refill their cylinders without hassle. This service contributes to the government’s efforts to promote clean cooking fuel and reduce the reliance on traditional fuels like wood and coal.

- Insurance Premium Payments

Insurance plays a crucial role in financial planning and risk management. It offers a platform for paying insurance premiums, including life, health, vehicle, and other insurance policies. This service ensures that policyholders can conveniently renew their policies and maintain insurance coverage without any disruptions.

- Loan Repayment

BBPS extends its services to include loan repayment for various types of loans, such as personal loans, home loans, and vehicle loans. Consumers can easily schedule loan payments through the BBPS platform, helping them manage their finances efficiently and avoid defaulting on loan repayments.

- Fastag Recharge

Fastag is an electronic toll collection system that enables seamless passage through toll plazas on highways. It allows users to recharge their Fastag accounts, ensuring uninterrupted travel and hassle-free toll payments. This service promotes the adoption of digital toll collection, reducing traffic congestion and fuel consumption.

- Broadband Bill Payments

In the digital age, reliable internet connectivity is essential for work, education, and entertainment. It enables users to pay their broadband bills from various service providers, ensuring uninterrupted access to high-speed internet services. This service promotes digital inclusion and connectivity in both urban and rural areas.

Conclusion

The Bharat Bill Payment System has revolutionized the way Indians pay their bills, offering a unified platform for various bill payments. Services such as electricity, water, LPG gas, insurance premiums, loan repayment, Fastag recharge, and broadband bill payments are now more accessible and convenient through BBPS. This system not only benefits consumers by providing a seamless payment experience but also enhances efficiency and transparency in bill payments across various sectors. As India continues its journey towards a digital economy, it plays a crucial role in driving financial inclusion and promoting digital payments nationwide.